Like Warm Apple Pie, the USA Comes of Age

By – Published on April 24, 2022

In order to insulate Russia’s economy from outside pressures, President Vladimir Putin had built sizeable currency reserves, including about $600B in US dollars. After the invasion of Ukraine, the United States shut off Russia’s access to almost all of it.

Essentially, they hit “delete” on the spreadsheet.

In the face of an invasion and hot war, this action seems warranted. I am not debating that - I am curious about what happens next…

USD reserves are the chosen safe haven asset class for central banks and mega corporations all over the world. When the United States took Russia’s USD currency reserves away, a new precedent was set, with a message loud and clear - currency reserves can be confiscated, at the United States discretion.

Dominoes

Russia was deemed a bad actor for obvious reasons - but this move sets new rules for dealing with bad actors. It is worth noting the list of countries the US has deemed a “bad actor” during the last 60 years includes almost every present day US ally - including Israel, France, Germany, Japan and many more. Status quo bias tricks us into thinking that the way things are today is the way things will always be, but geopolitical relationships have alway been a moving target.

When a new precedent results in an increase of power and control, it always becomes a slippery slope. It took a hot war to break the ice, but now the door is open. No doubt, central banks around the world are debating how safe their safe haven currency reserves are.

Last week, Israel’s central bank made the biggest philosophical change to its currency reserves ever, adding the Chinese Yuan, and reducing its exposure to US dollars.

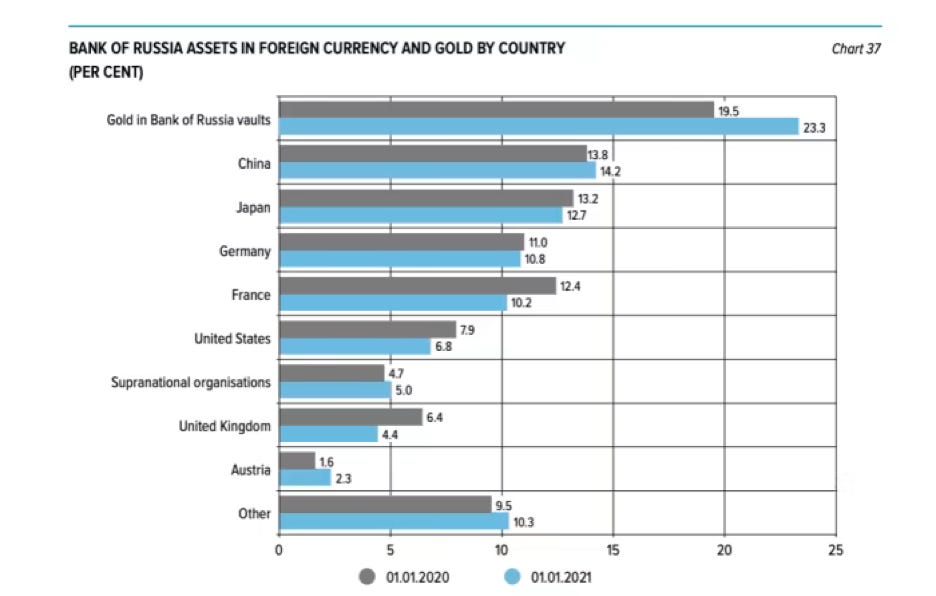

Russia, in obvious anticipation of becoming a Pariah state, had already been liquidating its reserves of USD, Euros and Pounds in exchange for Gold and Yuan over recent years. Below are the net changes in account of Russia’s Foreign currency and gold assets in the last year:

Source Bank of Russia 2020 Annual Report

Central banks around the world have been increasing their gold holdings, (Except Canada, the Bank of Canada actually owns less gold than I do personally - I will be grilling former PM Stephen Harper about that at my upcoming conference in Vancouver on May 17/18), however, nearly all countries store their gold holdings in vaults beneath the Bank of England, or in the coffers of the New York Federal Reserve. This is because London and New York are the centres of the global gold market, making it easier to trade as they need.

Russia, conversely, has kept all $130 billion of its gold wealth within the Russian Federation, immunizing it from sanctions.

It is worth noting that many European countries have been repatriating their gold (shipping it home) over recent years in record numbers. It’s probably nothing…

Canada, by contrast, is the only G7 Nation that has zero gold holdings. In fact, Canada is the only G20 Nation that has zero gold holdings.

We could expand similar criteria to the G7, G8 and G20 nations to create a fictitious “G100”… and you get my point… Canada would still be the only country in the 100 to lack any gold reserves. Look deeper if you want to.

Apple Pie is Growing Up

I subscribe to a handful of research services, but the account I have held for the longest is my subscription to George Friedman at Geopolitical Futures. Those familiar will appreciate that I was a Stratfor subscriber back in the old days, and moved with George when he sold Stratfor and built GPF.

George has been calling for this event for a decade, stating that in order for the United States to reach the next evolution of Empire it will need to mature away from throwing boots on the ground military support at every problem. A smart Empire, according to George, leverages its economic strength and political relationships to manipulate the world without itself engaging in war. I had George on my podcast last week to talk about this. He believes these unprecedented sanctions are the United States learning to flex it’s muscle in more intelligent ways - as opposed to, for example, enacting a no-fly zone over Ukraine, which would require the US to take hot military action if breached.

I published some clips of my George Friedman interview on Youtube and it is safe to say that the internet does not love his opinion. Popular sentiment in the Twitter/Youtube world would lead you to believe that the United States is an Empire in decay, with a doomed currency and faltering global alliances.

I don’t buy that.

I view the US as an accidental empire, it fell into the role somewhat unintentionally. It was a newly invented nation, pulled from it’s isolationist values when Pearl Harbour was bombed, and Americans realized that in order to keep themselves safe they needed to be in control of what everybody else was doing all of the time, or forever be at risk of another blindside attack.

This response became a massive overreaction, and over the course of the next 60 years American troops launched into every squabble and confrontation until it was literally drowning in insurgencies.

But adolescence is a learning curve for everyone. I think America is growing up.

The knee jerk reaction to America weaponizing the dollar as it has with Russia, is that the world will follow in Israel's footsteps and abandon USD for a more reliable asset - to which I ask, what is that asset?

The trend of Central Banks increasing their gold holdings will continue, and when Canada elects an adult for a Prime Minister, we may join them.

I’ll quote one of my favourite macro analysts, Luke Gromen:

“There are very few moments in history when you want to own gold, but during those moments, gold is about all you want to own.”

What Do They Really Think?

The best way to get a read on global perception of the US dollar would be to sit down with the leaders of two of the United States largest trading partners…

The 22nd Prime Minister of Canada, Stephen Harper and the 63rd President of Mexico, Felipe Calderón, managed their countries through the fracturing of the US financial system in 2008 - the last time the world seriously questioned the viability of the US dollar as the world reserve currency. Everyone watched as the worlds’ super power almost tanked the entire global financial system due to reckless fiscal mismanagement.

On April 22, 2008, American President George Bush called Prime Minister Harper and President Calderon to meet behind closed doors in New Orleans to discuss the impending financial crisis. The purpose of the meeting was to project an air of confidence among the NAFTA partners and quell the public concern. In the details, Prime Minister Harper received assurances for Canadian oil exports, and in exchange agreed not to push NAFTA renegotiations until Bush left office. President Calderon received a promise of support for the Mexican peso. That one didn’t work out so well, the Peso plummeted to a decade low.

Similar conversations are happening behind closed doors today, but as the public focuses on last week’s headlines, our central planners are already building the world of 2030.

I don’t subscribe to the belief that Central Bankers are short sighted fools, kicking the can down the road one year at a time. I believe they are playing a game that no-one has played before, while managing at obscene scale. Like anyone who fought to reach the top of an organization, they will fight to maintain and increase their power at almost any cost. They will be ruthless if they believe the ends justify the means.

So What are the Ends and What are the Means?

Join me on May 17 and 18 in Vancouver, BC, to find out.

I am flying in former Prime Minister Harper, former President Calderón, former Federal Reserve Insider Danielle DiMartino Booth, Legendary Investor Robert “Rich Dad” Kiyosaki and dozens and dozens more to hear perspectives, share investment strategies, and decide where my money is going in 2022.

I will be sitting down with Nomi Prins, the best selling author of All the Presidents Bankers, Other People’s Money and Collusion: How the central bankers rigged the world. Nomi was a young Wall Street legend and built many of the complex financial instruments used by big banks today before shifting her focus to vigilante financial journalism.

In addition, I am flying in close to 100 of the most legendary investors, stock pickers and newsletter writers in the commodity business.

I have made this event so comprehensive and accessible that I honestly cannot understand why somebody who wants to make money could afford to miss it.

Our VIP passes are now sold out - general admission and Super VIP are still available, although I expect the Super VIP’s to go by the end of the week.

It’s going to be a party. I can’t wait. Click here to join us.

Comments